Understanding Islamic Forex Trading Principles and Practices 1722069344

Understanding Islamic Forex Trading: Principles and Practices

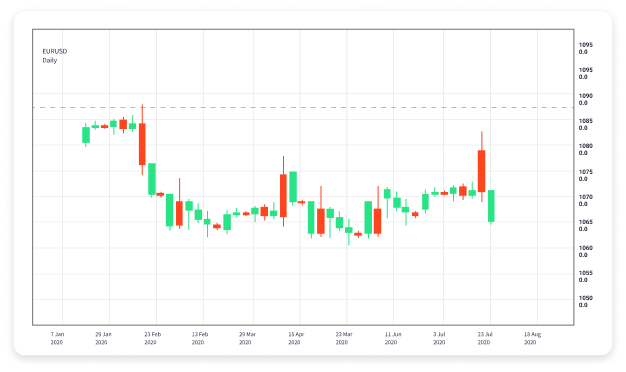

Forex trading is a popular market for investors globally. However, for Muslim traders, it presents unique challenges and considerations concerning Sharia law. Islamic forex trading upholds the principles of ethical conduct without involvement in Riba (usury) or Gharar (excessive uncertainty). This article delves into the fundamental aspects of Islamic forex trading, offering guidelines on how Muslims can engage in this financial market responsibly. For comprehensive insights, visit islamic forex trading https://tradingarea-ng.com/.

What is Islamic Forex Trading?

Islamic forex trading refers to trading currencies in a manner that complies with Islamic law. The forex market itself is a decentralized market for trading currencies. It’s crucial for Islamic traders to engage in this market without violating principles laid out in the Quran and Hadith. Islamic finance focuses on risk-sharing and profit-sharing practices rather than interest-driven income, making it necessary to adapt conventional trading strategies to satisfy these conditions.

The Core Principles of Islamic Finance

To understand Islamic forex trading properly, one must first grasp the essential concepts of Islamic finance. Here are the core principles:

- Riba (Usury): The charging of interest is strictly prohibited in Islam. Any income generated from interest constitutes Riba.

- Gharar (Excessive Uncertainty): Engaging in transactions laden with uncertainty is not permissible. Traders must ensure they have clear and defined contracts.

- Halal Investments: Investments must be made in activities and businesses that are considered halal (permissible) in Islam.

- Profit-Sharing: Islamic finance emphasizes shared risk and profit, necessitating partnerships and equity-based investment strategies.

How Islamic Forex Trading Works

Islamic forex trading is typically conducted through Islamic forex accounts, which ensure that trades are compliant with Sharia law. Here’s how it works:

1. Swap-Free Accounts

Many forex brokers offer swap-free accounts that allow Muslim traders to participate in forex trading without incurring interest on overnight positions. These accounts eliminate any form of interest payments for holding positions overnight, thereby aligning with the Islamic prohibition of Riba.

2. Short-Term Trading Strategies

Day trading and other short-term trading strategies are often favored by Islamic traders. By closing positions within the same day, traders can avoid overnight fees while following Islamic guidelines.

3. Ethical Trading Practices

Adhering to ethical trading practices is vital. This means ensuring that the trading strategies employed don’t exploit others or involve excessive risk. Traders should focus on transparent processes and avoid any form of deceit or misrepresentation.

Finding the Right Broker

Selecting a forex broker that offers Islamic trading accounts is essential for compliance with Muslims’ religious beliefs. Here are a few tips for finding the right broker:

- Regulation: Ensure that the broker is regulated by reputable financial authorities. This adds a layer of security and trust.

- Swap-Free Options: Look specifically for brokers that provide swap-free accounts, ensuring there are no interest charges.

- Transparent Fees: Review the broker’s fee structure carefully. There should be no hidden fees related to interest.

- Customer Support: Opt for brokers known for excellent customer service, especially if you require assistance concerning Sharia-compliant trading.

The Benefits of Islamic Forex Trading

Islamic forex trading offers several advantages, particularly for Muslim traders:

- Sharia Compliance: Engaging in trading that adheres strictly to Islamic principles allows traders to invest morally and ethically.

- Flexibility and Accessibility: The forex market operates 24 hours a day, making it flexible for traders to engage at their convenience.

- Diverse Opportunities: The forex market offers a myriad of trading options, including major, minor, and exotic currency pairs, allowing traders to diversify their portfolios.

Challenges Faced by Islamic Traders

While there are benefits, Islamic forex trading also comes with challenges:

- Lack of Awareness: Many brokers may not fully understand Islamic requirements, leading to potential compliance issues.

- Limited Choice of Brokers: Not all brokers cater to Muslim traders, limiting options for setting up Islamic accounts.

- Market Volatility: The forex market can be highly volatile, which can pose risks even for compliant trading.

Conclusion

Engaging in forex trading as a Muslim trader requires a thorough understanding of Islamic finance principles. By adhering to guidelines such as avoiding Riba and Gharar, and seeking brokers offering swap-free accounts, Islamic traders can operate within the forex market responsibly. As the demand for ethical investment continues to grow, understanding these principles becomes increasingly essential for traders around the globe.

In conclusion, Islamic forex trading not only enables Muslims to participate in global markets but also reinforces the importance of ethical behavior in financial transactions. By aligning trading practices with their faith, Islamic traders can enjoy the benefits of forex trading while staying true to their beliefs.

- ! Без рубрики 146

- 1 2

- 1 Vin 743 1

- 1 Win 13 3

- 1 Win 136 3

- 1 Win 161 3

- 1 Win 203 3

- 1 Win 24 3

- 1 Win 241 3

- 1 Win 253 2

- 1 Win 265 3

- 1 Win 295 3

- 1 Win 360 3

- 1 Win 362 3

- 1 Win 40 3

- 1 Win 414 3

- 1 Win 440 5

- 1 Win 548 1

- 1 Win 552 3

- 1 Win 563 1

- 1 Win 587 3

- 1 Win 637 3

- 1 Win 645 3

- 1 Win 66 3

- 1 Win 69 3

- 1 Win 702 3

- 1 Win 793 3

- 1 Win 812 3

- 1 Win 815 3

- 1 Win 859 3

- 1 Win 869 3

- 1 Win 90 3

- 1 Win 922 1

- 1 Win 93 3

- 1 Win 996 3

- 1 Win App 581 3

- 1 Win App 940 3

- 1 Win App Download 930 3

- 1 Win App Login 274 3

- 1 Win App Login 597 2

- 1 Win App Login 670 3

- 1 Win App Login 708 3

- 1 Win Colombia 246 1

- 1 Win Colombia 783 2

- 1 Win Colombia 948 3

- 1 Win India 218 3

- 1 Win India 363 3

- 1 Win Login 127 3

- 1 Win Login 253 3

- 1 Win Login 330 3

- 1 Win Login 387 3

- 1 Win Login 474 3

- 1 Win Login 495 1

- 1 Win Login 779 1

- 1 Win Online 255 1

- 10 Jili Slot 198 2

- 10 Jili Slot 309 3

- 104 3

- 12 Play 674 3

- 12 Play Malaysia 198 3

- 12play Casino 52 3

- 12play Free Credit 87 3

- 12play My 111 3

- 12play My 98 3

- 12play Sg 768 3

- 12play Voucher Code 542 3

- 188 Bet 188 Bet 188bet 181 3

- 188 Bet 188 Bet 188bet 48 3

- 188 Bet 188 Bet 188bet 817 3

- 188 Bet 188bet ทาง เข้า 223 1

- 188 Bet 349 1

- 188 Bet 991 3

- 188 Bet Link 120 1

- 188 Bet Link 297 3

- 188 Bet Link 465 3

- 188 Bet Link 486 3

- 188 Bet Link 662 1

- 188 Bet Link 830 3

- 188 Bet Link 884 3

- 188 Bet ทางเข้า 301 3

- 188 Bet ทางเข้า 805 2

- 188 Pg Bet 24 3

- 188bet 250 136 1

- 188bet 250 202 1

- 188bet 250 367 3

- 188bet 250 66 3

- 188bet 250 696 3

- 188bet 250 839 3

- 188bet 50 Reais 476 3

- 188bet 68183 69 3

- 188bet 68183 939 1

- 188bet Apk 623 3

- 188bet App 279 3

- 188bet App 32 1

- 188bet App 797 3

- 188bet App 841 3

- 188bet Blog 719 1

- 188bet Cho Dien Thoai 416 2

- 188bet Cho Dien Thoai 428 3

- 188bet Cho Dien Thoai 649 4

- 188bet Cho Dien Thoai 66 3

- 188bet Codes 181 3

- 188bet Codes 626 3

- 188bet Dang Ky 144 3

- 188bet Dang Ky 81 3

- 188bet Dang Ky 869 2

- 188bet Dang Nhap 522 3

- 188bet Dang Nhap 823 1

- 188bet Dang Nhap 898 2

- 188bet Dang Nhap 966 3

- 188bet Danhbai123 213 3

- 188bet Danhbai123 85 3

- 188bet Danhbai123 954 2

- 188bet Download Ios 212 1

- 188bet E Confiavel 324 3

- 188bet Hiphop 380 3

- 188bet Hiphop 599 3

- 188bet Link 120 3

- 188bet Link 484 3

- 188bet Link 702 3

- 188bet Login 897 3

- 188bet Login Link Alternatif 376 1

- 188bet Nha Cai 404 3

- 188bet Nha Cai 748 2

- 188bet Nha Cai 977 3

- 188bet Nha Cai 996 1

- 188bet One 709 3

- 188bet One 934 1

- 188bet Vao Bong 142 3

- 188bet Vao Bong 396 1

- 188bet Vao Bong 978 3

- 188bet Vn 209 2

- 188bet Vui 289 1

- 188bet Vui 41 3

- 188bet Vui 527 1

- 188bet Vui 641 3

- 188bet Vui 916 3

- 188bet มือถือ เข้าสู่ระบบ 147 2

- 188bet มือถือ เข้าสู่ระบบ 492 3

- 188bet 우회 176 1

- 188bet 우회 221 2

- 1bet5 1

- 1vin 131 3

- 1vin 176 3

- 1vin 349 2

- 1vin 497 3

- 1vin 579 3

- 1vin 641 3

- 1vin 683 3

- 1vin 890 3

- 1vin 933 3

- 1win Apk 2 1

- 1win Apk 505 3

- 1win Apk 796 3

- 1win Apk 828 3

- 1win Apk 845 3

- 1win Apk Download 857 3

- 1win Apostas 781 3

- 1win App 209 1

- 1win App 34 3

- 1win App 378 2

- 1win App 402 3

- 1win App 458 1

- 1win App 613 3

- 1win App 628 3

- 1win App 658 3

- 1win App 81 3

- 1win App 872 3

- 1win App 886 3

- 1win App 956 3

- 1win App Download 374 3

- 1win App Download 499 3

- 1win App Download 558 3

- 1win App Download 602 1

- 1win App Download 627 3

- 1win App Download 66 3

- 1win App Download 962 3

- 1win App Login 118 3

- 1win App Login 848 3

- 1win Apuestas 892 3

- 1win Apuestas 960 3

- 1win Aviator 177 3

- 1win Aviator 421 3

- 1win Aviator 689 3

- 1win Aviator 959 3

- 1win Azerbaycan 835 3

- 1win Bangladesh 741 3

- 1win Bet 112 3

- 1win Bet 164 3

- 1win Bet 171 3

- 1win Bet 179 3

- 1win Bet 199 3

- 1win Bet 427 3

- 1win Bet 480 3

- 1win Bet 491 3

- 1win Bet 495 3

- 1win Bet 524 2

- 1win Bet 526 3

- 1win Bet 527 3

- 1win Bet 528 3

- 1win Bet 569 3

- 1win Bet 657 3

- 1win Bet 752 3

- 1win Bet 77 3

- 1win Bet 792 3

- 1win Bet 825 3

- 1win Bet 849 3

- 1win Bet 900 3

- 1win Bet 931 3

- 1win Bet 972 3

- 1win Bet 986 3

- 1win Bet 990 2

- 1win Betting 292 3

- 1win Betting 500 1

- 1win Betting 709 3

- 1win Betting 799 2

- 1win Bonus 210 3

- 1win Bonus 319 3

- 1win Bonus 462 3

- 1win Bonus 825 3

- 1win Burkina Faso Apk 594 3

- 1win Casino 11 3

- 1win Casino 149 6

- 1win Casino 178 3

- 1win Casino 204 3

- 1win Casino 207 3

- 1win Casino 259 1

- 1win Casino 278 3

- 1win Casino 292 3

- 1win Casino 340 3

- 1win Casino 374 3

- 1win Casino 385 3

- 1win Casino 423 2

- 1win Casino 433 3

- 1win Casino 444 3

- 1win Casino 466 3

- 1win Casino 478 3

- 1win Casino 483 3

- 1win Casino 50 3

- 1win Casino 551 2

- 1win Casino 596 3

- 1win Casino 60 3

- 1win Casino 602 3

- 1win Casino 611 3

- 1win Casino 632 3

- 1win Casino 636 1

- 1win Casino 692 3

- 1win Casino 733 3

- 1win Casino 785 3

- 1win Casino 833 3

- 1win Casino 850 2

- 1win Casino 868 3

- 1win Casino 91 3

- 1win Casino 923 3

- 1win Casino 965 1

- 1win Casino 981 3

- 1win Casino 994 3

- 1win Casino App 961 3

- 1win Casino Argentina 929 3

- 1win Casino Chile 957 3

- 1win Casino Online 688 3

- 1win Casino Online 799 3

- 1win Casino Online 915 3

- 1win Chile 226 3

- 1win Connexion 660 3

- 1win Connexion 926 3

- 1win Cote Divoire Telecharger 694 3

- 1win Download 283 3

- 1win Download 376 3

- 1win Download 687 3

- 1win Download 811 3

- 1win Download 906 2

- 1win Egypt 294 3

- 1win Es Confiable 576 3

- 1win Game 408 3

- 1win Games 777 3

- 1win Games 797 3

- 1win Games 944 1

- 1win Giris 284 3

- 1win Giris 5 3

- 1win In 447 3

- 1win Italia 776 3

- 1win Kazahstan 452 3

- 1win Kazino 105 3

- 1win Kazino 112 3

- 1win Kazino 338 3

- 1win Kazino 4 1

- 1win Kazino 400 3

- 1win Kazino 611 3

- 1win Kazino 631 3

- 1win Kazino 674 1

- 1win Kazino 705 3

- 1win Kazino 92 3

- 1win Kazino 921 3

- 1win Kz 340 3

- 1win Login 101 3

- 1win Login 102 3

- 1win Login 110 1

- 1win Login 158 3

- 1win Login 196 3

- 1win Login 225 3

- 1win Login 250 3

- 1win Login 255 1

- 1win Login 325 3

- 1win Login 329 3

- 1win Login 370 3

- 1win Login 451 2

- 1win Login 46 3

- 1win Login 525 3

- 1win Login 537 1

- 1win Login 576 3

- 1win Login 612 3

- 1win Login 687 1

- 1win Login 701 3

- 1win Login 722 2

- 1win Login 748 3

- 1win Login 770 3

- 1win Login 857 3

- 1win Login 860 3

- 1win Login 874 3

- 1win Login 883 3

- 1win Login 900 3

- 1win Login 95 3

- 1win Login 961 3

- 1win Login 962 1

- 1win Login India 392 3

- 1win Login India 554 3

- 1win Login Indonesia 797 3

- 1win Login Nigeria 736 3

- 1win Mali Apk 120 3

- 1win Nigeria 27 3

- 1win Official 163 3

- 1win Official 192 3

- 1win Official 362 3

- 1win Official 520 3

- 1win Official 90 3

- 1win Official 913 3

- 1win Official 93 3

- 1win Oficial 681 3

- 1win Onlain 192 3

- 1win Onlain 231 3

- 1win Onlain 309 3

- 1win Onlain 314 3

- 1win Onlain 512 3

- 1win Onlain 637 3

- 1win Onlain 66 3

- 1win Onlain 940 2

- 1win Online 116 3

- 1win Online 135 3

- 1win Online 198 3

- 1win Online 212 3

- 1win Online 23 1

- 1win Online 282 3

- 1win Online 292 3

- 1win Online 303 3

- 1win Online 353 3

- 1win Online 377 3

- 1win Online 40 3

- 1win Online 405 3

- 1win Online 422 3

- 1win Online 434 3

- 1win Online 447 2

- 1win Online 470 2

- 1win Online 559 3

- 1win Online 591 3

- 1win Online 636 3

- 1win Online 729 3

- 1win Online 751 3

- 1win Online 864 3

- 1win Online 89 3

- 1win Online 95 3

- 1win Online 969 3

- 1win Oyna 843 3

- 1win Pakistan 655 3

- 1win Qeydiyyat 544 3

- 1win Register 219 3

- 1win Register 233 3

- 1win Register 237 3

- 1win Register 614 3

- 1win Register 685 3

- 1win Register 708 3

- 1win Register 772 2

- 1win Register Login 282 3

- 1win Registratsiya 270 3

- 1win Registratsiya 293 3

- 1win Registratsiya 532 3

- 1win Registratsiya 725 3

- 1win Registratsiya 830 3

- 1win Registratsiya 855 3

- 1win Registratsiya 872 3

- 1win Registratsiya 997 3

- 1win Sait 125 3

- 1win Sait 209 1

- 1win Sait 269 3

- 1win Sait 292 3

- 1win Sait 364 3

- 1win Sait 376 3

- 1win Sait 381 3

- 1win Sait 532 2

- 1win Sait 659 3

- 1win Sayt 280 3

- 1win Senegal 918 3

- 1win Senegal Apk 179 3

- 1win Senegal Apk 284 1

- 1win Senegal Apk Ios 649 3

- 1win Senegal Telecharger 836 3

- 1win Sign In 365 3

- 1win Sign In 446 3

- 1win Sign In 52 3

- 1win Sign In 761 3

- 1win Sign In 895 3

- 1win Sign Up 574 1

- 1win Site 252 3

- 1win Site 375 2

- 1win Site 954 3

- 1win Skachat 174 3

- 1win Skachat 277 3

- 1win Skachat 306 3

- 1win Skachat 410 3

- 1win Skachat 605 3

- 1win Skachat 662 3

- 1win Skachat 674 3

- 1win Skachat 781 3

- 1win Telecharger 58 3

- 1win Telecharger 813 3

- 1win Uganda 34 3

- 1win Ukraina 573 3

- 1win Vhod 112 3

- 1win Vhod 205 3

- 1win Vhod 272 3

- 1win Vhod 540 1

- 1win Vhod 622 3

- 1win Vhod 769 3

- 1win Vhod 812 3

- 1win Vhod 914 2

- 1win Vhod 98 2

- 1win Yukle 431 3

- 1win 먹튀 151 3

- 1win 후기 249 3

- 1win-kirish.org 1

- 1win-qeydiyyat.com 1

- 1winazerbaycan.org 1

- 1x-bet.downloa 1

- 1xbet-royxatdan-otish.com 1

- 1xbet1 2

- 1xbet2 1

- 1xbet3 1

- 1xbet32 1

- 1xbet3231025 1

- 1xbet4 1

- 1xbet51 1

- 1xbet52 1

- 1xbet61 1

- 1xbet62 1

- 1xbet82 1

- 1xbetcasinoonline.com 1

- 2 1

- 20 Bet 171 3

- 20 Bet 178 3

- 20 Bet 249 3

- 20 Bet 362 3

- 20 Bet 435 3

- 20 Bet 481 3

- 20 Bet 499 1

- 20 Bet 540 3

- 20 Bet 762 3

- 20 Bet App 222 3

- 20 Bet App 309 3

- 20 Bet App 344 3

- 20 Bet App 398 3

- 20 Bet App 808 3

- 20 Bet Bet 173 3

- 20 Bet Bet 183 3

- 20 Bet Bet 359 1

- 20 Bet Bet 816 3

- 20 Bet Bet 949 3

- 20 Bet Bet 978 3

- 20 Bet Bonus Code 291 3

- 20 Bet Bonus Code 516 3

- 20 Bet Bonus Code 862 3

- 20 Bet Casino 160 3

- 20 Bet Casino 168 3

- 20 Bet Casino 256 3

- 20 Bet Casino 339 3

- 20 Bet Casino 351 3

- 20 Bet Casino 453 3

- 20 Bet Casino 480 3

- 20 Bet Casino 533 3

- 20 Bet Casino 54 3

- 20 Bet Casino 550 3

- 20 Bet Casino 689 3

- 20 Bet Casino 766 2

- 20 Bet Casino 811 1

- 20 Bet Casino 848 3

- 20 Bet Casino 892 3

- 20 Bet Casino 930 3

- 20 Bet Casino App 536 3

- 20 Bet Casino App 906 3

- 20 Bet Casino Login 593 3

- 20 Bet Casino Login 720 3

- 20 Bet Casino Login 858 3

- 20 Bet Com 317 3

- 20 Bet Com 415 1

- 20 Bet Com 495 3

- 20 Bet Com 529 3

- 20 Bet Com 639 3

- 20 Bet Com 834 3

- 20 Bet Como Retirar Dinero 770 3

- 20 Bet De 27 3

- 20 Bet De 296 3

- 20 Bet E Confiavel 769 3

- 20 Bet Login 212 1

- 20 Bet Login 392 3

- 20 Bet Login 624 3

- 20 Bet Login 747 2

- 20 Bet Login 947 3

- 20 Bet Promo Code 360 3

- 20 Bet Promo Code 742 1

- 20 Bet Promo Code 827 3

- 20 Bet Tv Login 576 3

- 20 Bet Tv Login 734 3

- 20 Bet Tv Login 775 3

- 20 Bet Tv Login 828 3

- 20 Bet Website 453 3

- 20 Luck Bet 533 3

- 20 Luck Bet 830 3

- 20 Pm Bet 868 3

- 20 Win Bet 925 3

- 20bet Apk 194 3

- 20bet Apk 231 3

- 20bet Apk 395 3

- 20bet Apk 603 3

- 20bet App 147 3

- 20bet App 168 4

- 20bet App 305 3

- 20bet App 571 3

- 20bet App 601 3

- 20bet Apuestas 223 3

- 20bet Belepes 153 3

- 20bet Bewertung 942 3

- 20bet Bono Sin Deposito 416 3

- 20bet Bono Sin Deposito 521 3

- 20bet Bonus 38 3

- 20bet Bonus 413 3

- 20bet Bonus 61 2

- 20bet Bonus 704 3

- 20bet Bonus 713 3

- 20bet Bonus Bez Depozytu 24 3

- 20bet Bonus Bez Depozytu 446 3

- 20bet Bonus Bez Depozytu 602 1

- 20bet Bonus Bez Depozytu 785 3

- 20bet Bonus Code 548 3

- 20bet Bonus Code 551 3

- 20bet Bonus Code 581 2

- 20bet Bonus Code 769 3

- 20bet Bonus Code 805 3

- 20bet Bonus Code 961 3

- 20bet Bonus Code Ohne Einzahlung 214 3

- 20bet Bonus Code Ohne Einzahlung 388 3

- 20bet Bonus Code Ohne Einzahlung 48 3

- 20bet Bonus Code Ohne Einzahlung 529 3

- 20bet Bonus Code Ohne Einzahlung 611 3

- 20bet Bonus Code Ohne Einzahlung 673 3

- 20bet Bonus Code Ohne Einzahlung 752 3

- 20bet Casino 138 1

- 20bet Casino 142 1

- 20bet Casino 155 3

- 20bet Casino 2 3

- 20bet Casino 279 4

- 20bet Casino 285 1

- 20bet Casino 335 3

- 20bet Casino 389 3

- 20bet Casino 392 3

- 20bet Casino 50 Free Spins 475 3

- 20bet Casino 519 3

- 20bet Casino 568 3

- 20bet Casino 623 3

- 20bet Casino 677 3

- 20bet Casino 815 3

- 20bet Casino 845 3

- 20bet Casino 963 3

- 20bet Casino App 114 3

- 20bet Casino App 218 3

- 20bet Casino App 434 3

- 20bet Casino App 600 3

- 20bet Casino App 715 3

- 20bet Casino App 927 3

- 20bet Casino Login 375 3

- 20bet Casino Login 513 3

- 20bet Casino Login 57 3

- 20bet Casino Login 580 2

- 20bet Casino Login 715 3

- 20bet Casino Logowanie 241 3

- 20bet Casino No Deposit Bonus Code 199 2

- 20bet Casino No Deposit Bonus Code 200 3

- 20bet Casino No Deposit Bonus Code 308 3

- 20bet Casino No Deposit Bonus Code 325 1

- 20bet Casino No Deposit Bonus Code 399 3

- 20bet Casino No Deposit Bonus Code 463 3

- 20bet Casino No Deposit Bonus Code 90 3

- 20bet Casino No Deposit Bonus Code 996 3

- 20bet Casino Review 491 1

- 20bet Com 57 3

- 20bet Cz 6 1

- 20bet E Confiavel 677 1

- 20bet E Confiavel 912 3

- 20bet E Legal Em Portugal 338 3

- 20bet Erfahrungen 141 3

- 20bet Erfahrungen 745 3

- 20bet Erfahrungen 827 3

- 20bet Erfahrungen 834 3

- 20bet Espana 400 3

- 20bet Espana 896 1

- 20bet Greece 649 3

- 20bet Italia 461 3

- 20bet Italia 668 3

- 20bet Italia 987 3

- 20bet Kasyno 595 3

- 20bet Kod Promocyjny 232 3

- 20bet Kod Promocyjny 791 3

- 20bet Kod Promocyjny Bez Depozytu 535 3

- 20bet Live 567 3

- 20bet Live 659 3

- 20bet Login 286 3

- 20bet Login 31 3

- 20bet Login 317 3

- 20bet Login 322 3

- 20bet Login 53 3

- 20bet Login 644 3

- 20bet Login 691 3

- 20bet Login 785 3

- 20bet Login 802 3

- 20bet Logowanie 368 3

- 20bet Logowanie 439 3

- 20bet Logowanie 824 3

- 20bet Logowanie 913 3

- 20bet Norge 955 3

- 20bet Online Casino 997 3

- 20bet Opinie 473 3

- 20bet Opinie 685 3

- 20bet Opinie 863 3

- 20bet Osterreich 536 3

- 20bet Peru 665 3

- 20bet Pl 105 3

- 20bet Pl 230 1

- 20bet Pl 994 3

- 20bet Play 649 3

- 20bet Play 758 3

- 20bet Portugal 306 3

- 20bet Portugal 436 3

- 20bet Portugal 444 1

- 20bet Promo Code 192 3

- 20bet Promo Code 574 3

- 20bet Promo Code 670 3

- 20bet Promo Code 701 3

- 20bet Promo Code 706 2

- 20bet Recensioni 138 3

- 20bet Recensioni 596 3

- 20bet Recensioni 950 3

- 20bet Reviews 294 3

- 20bet Reviews 823 3

- 20bet Scommesse 102 3

- 20bet Scommesse 136 3

- 20bet Scommesse 436 2

- 20bet Scommesse 611 3

- 20bet Scommesse 619 3

- 20bet Scommesse 79 3

- 20bet Slovenija 206 3

- 20bet Tv 971 3

- 20bet Απατη 468 3

- 20bet Απατη 590 3

- 20bet Απατη 839 3

- 20bet Απατη 951 3

- 20bet Τηλεφωνο Επικοινωνιας 493 3

- 20bet 入金 176 3

- 20bet 入金 426 2

- 20bet 入金 640 3

- 20bet 入金しないと見れない 324 3

- 20bet 入金しないと見れない 714 3

- 20bet 入金しないと見れない 791 3

- 20bet 入金方法 571 3

- 20bet 入金方法 712 2

- 20bet 入金方法 764 3

- 20bet 登録 773 3

- 20bet 登録 951 2

- 20bet 登録方法 307 3

- 20bet 見るだけ 400 3

- 20bet 見るだけ 695 3

- 20bet 視聴方法 927 3

- 20bet 評判 421 3

- 20bet 評判 535 3

- 20bet 評判 732 2

- 22 Bet 302 1

- 22 Bet 482 3

- 22 Bet 531 1

- 22 Bet 589 3

- 22 Bet 637 3

- 22 Bet Casino 12 3

- 22 Bet Casino 297 3

- 22 Hellspin E Wallet 372 3

- 22 Hellspin E Wallet 596 3

- 22 Hellspin E Wallet 849 3

- 22 Hellspin E Wallet 86 3

- 22bet Apk 227 2

- 22bet Apk 250 3

- 22bet Apk 428 3

- 22bet App 990 3

- 22bet Casino 150 3

- 22bet Casino 329 3

- 22bet Casino 437 2

- 22bet Casino 750 3

- 22bet Casino 762 3

- 22bet Casino Espana 180 3

- 22bet Casino Espana 404 3

- 22bet Casino Espana 510 3

- 22bet Casino Espana 566 3

- 22bet Casino Espana 748 1

- 22bet Casino Espana 760 2

- 22bet Casino Espana 767 3

- 22bet Casino Espana 897 3

- 22bet Casino Espana 967 1

- 22bet Casino Login 166 3

- 22bet Casino Login 367 3

- 22bet Casino Login 368 3

- 22bet Casino Login 847 1

- 22bet Casino Login 850 3

- 22bet Espana 252 3

- 22bet Espana 327 3

- 22bet Espana 36 3

- 22bet Espana 422 3

- 22bet Espana 594 3

- 22bet Espana 625 3

- 22bet Espana 811 1

- 22bet Espana 898 1

- 22bet Login 167 3

- 22bet Login 189 3

- 22bet Login 21 3

- 22bet Login 788 3

- 22bet Login 89 1

- 22betofficial.com 1

- 268 3

- 281 3

- 327 3

- 373 2

- 378 1

- 40-burning-hot-6-reels.gr 2

- 408 3

- 50 Free Spins Ggbet 974 3

- 50 Free Spins No Deposit Ggbet 155 3

- 50 Free Spins No Deposit Ggbet 257 3

- 50 Free Spins No Deposit Ggbet 307 3

- 50 Free Spins No Deposit Ggbet 324 1

- 50 Free Spins No Deposit Ggbet 804 3

- 50 Free Spins No Deposit Ggbet 953 2

- 50 Fs Ggbet 399 3

- 530 3

- 580 1

- 692 3

- 714 2

- 749 3

- 777 Slot 135 3

- 777 Slot 184 3

- 777 Slot 222 3

- 777 Slot 332 3

- 777 Slot 468 3

- 777 Slot 933 3

- 777 Slot Game 100 3

- 777 Slot Game 126 3

- 777 Slot Game 202 3

- 777 Slot Game 437 2

- 777 Slot Game 543 3

- 777 Slot Vip 402 3

- 777 Slot Vip 496 3

- 777 Slot Vip 699 3

- 777 Slot Vip 811 3

- 777 Slot Vip 848 1

- 777 Slot Vip 969 3

- 777 Slot Vip 973 3

- 777 Tadhana Slot 203 3

- 777 Tadhana Slot 371 3

- 777 Tadhana Slot 64 3

- 777 Tadhana Slot 691 3

- 777 Tadhana Slot 780 2

- 777 Tadhana Slot 957 3

- 777slot Casino Login 461 3

- 777slot Free 100 298 3

- 777slot Free 100 788 3

- 777slot Free 100 871 3

- 777slot Login 352 3

- 777slot Login 709 3

- 777slot Login 972 3

- 777slot Ph 107 1

- 777slot Ph 299 3

- 777slot Ph 797 3

- 777slot Vip 271 3

- 777slot Vip 342 3

- 777slot Vip Login 365 3

- 777slot Vip Login 690 2

- 777slot Vip Login 750 3

- 777slot Vip Login 82 2

- 777slot Vip Login 996 11

- 792 3

- 7games Bet Casino 528 1

- 843 3

- 857 2

- 888 Casino App 339 5

- 888 Casino App 481 2

- 888 Casino App 50 3

- 888 Casino App 679 3

- 888 Casino Free Spins 306 1

- 888 Casino Free Spins 517 1

- 888 Casino Free Spins 873 3

- 888 Casino Login 907 3

- 888 Jili Casino 249 3

- 888 Jili Casino 599 3

- 888 Jili Casino 942 3

- 888 Online Casino 114 3

- 888 Online Casino 338 3

- 888 Starz Bet 813 3

- 888 Starz Casino 123 3

- 888 Starz Casino 47 3

- 888casino 520 3

- 888casino 918 3

- 888casino Apk 202 2

- 888casino Apk 241 3

- 888casino Login 863 3

- 888starz Bet 609 3

- 888starz Bet 611 3

- 888starz Bet 843 3

- 888starz Bonus 69 2

- 888starz Bonus Code 766 3

- 888starz Bonusy 49 3

- 888starz Bonusy 537 3

- 888starz Bonusy 839 2

- 888starz Bonusy 942 3

- 888starz Casino 775 1

- 888starz Kasyno 67 3

- 899 3

- 8k8 Casino Slot 191 1

- 8k8 Casino Slot 365 3

- 8k8 Casino Slot 429 6

- 8k8 Casino Slot 5 3

- 8k8 Casino Slot 561 3

- 8k8 Casino Slot 82 3

- 8k8 Slot 479 3

- 8k8 Slot 527 3

- 8k8 Slot 775 3

- 8k8 Slot 965 3

- 8k8 Slot Casino 154 2

- 8k8 Slot Casino 305 1

- 8k8 Slot Casino 417 1

- 8k8 Slot Casino 465 3

- 8k8 Slot Casino 554 3

- 8k8 Slot Casino 665 3

- 8k8 Vip Slot 449 3

- 8k8 Vip Slot 539 3

- 8k8 Vip Slot 562 3

- 8k8 Vip Slot 893 3

- 8k8 Vip Slot 926 3

- 8x Bet 416 3

- 8x Bet 554 3

- 8x Bet 657 6

- 8xbet 1598921127 106 1

- 8xbet 1598921127 961 3

- 8xbet App 526 3

- 8xbet App 650 3

- 8xbet App 662 3

- 8xbet App Tai 448 3

- 8xbet App Tai 498 3

- 8xbet Casino 953 3

- 8xbet Com 696 3

- 8xbet Com 847 3

- 8xbet Dang Nhap 230 1

- 8xbet Dang Nhap 396 3

- 8xbet Download 323 2

- 8xbet Man City 170 3

- 8xbet Man City 346 3

- 8xbet Man City 501 3

- 8xbet Man City 502 2

- 8xbet Man City 602 3

- 8xbet Online 302 3

- 8xbet Online 484 3

- 8xbet Tai 964 3

- 8xbet Tai 981 3

- 8xbet Vina 235 3

- 8xbet Vina 489 3

- 8xbet Vina 784 3

- 8xbet Vina 963 1

- 949 1

- 989 1

- a16z generative ai 5

- a16z generative ai 1 2

- Aajogo Crash 355 3

- adaly.es 2

- adobe generative ai 1 1

- adobe generative ai 2 1

- agrofair.uz 1

- Ai News 2

- ambridgeevents.com 1

- ancorallZ 8

- ancorallZ 100 10

- ancorallZ 1000 2

- ancorallZ 1250 6

- ancorallZ 1300 3

- ancorallZ 1500 29

- ancorallZ 1500_2 1

- ancorallZ 2000 12

- ancorallZ 261 1

- ancorallZ 3000 20

- ancorallZ 500 2

- ancorallZ 800 1

- ancorallZ 900 1

- anonymous 10

- Aplicativo Blaze Apostas 267 3

- Aplicativo Blaze Apostas 309 3

- App Betano 268 3

- App Hellspin 253 3

- App Star Casino Come Funziona 942 3

- App Starcasino 857 3

- Asia 12 Play 8 3

- Asia 12play 116 3

- Asia 12play 737 3

- Avantgarde Casino Login 547 3

- Avantgarde Casino No Deposit Bonus 160 3

- Avantgarde Casino Promotions 191 3

- Avantgardecasino 328 3

- Aviator Betting Game 353 3

- Aviator Demo 288 3

- Aviator Oyna Demo 724 3

- Aviator Slot 36 3

- ayrena.es 1

- B1bet Afiliados 22 3

- B1bet Login 428 3

- Baixar Aplicativo Vai De Bet 7 3

- Baixar Betano Apk 567 2

- Baji App 82 3

- Baji App Login 283 3

- Baji Apps 319 3

- bancorallZ 100 7

- bancorallZ 1000 3

- bancorallZ 1250 6

- bancorallZ 250 1

- bancorallZ 50% 34

- bancorallZ 500 2

- bancorallZ 750 2

- Baterybet Login 73 3

- Baterybet Promo Code 581 3

- Battery Betting App 36 3

- Battery Casino 357 3

- Bay 888 Casino 445 1

- baytronik.com 1

- bcg4 1

- bcgame1 3

- bcgame2 3

- bcgame3 2

- Bd Baji App 409 3

- Bdm Bet Casino 195 3

- Bdm Bet Espana 167 3

- Bdm Bet Promo Code 337 3

- Bdm Bet Promo Code 466 3

- Bdmbet App 815 3

- bdsm-shop-24.de 4

- beach5.ch_betonred 1

- Becric Aviator App 217 3

- bendicon.com 2

- Best Online Kiwi Casino 59 3

- Bet 188 286 2

- Bet 188 325 3

- Bet 188 425 2

- Bet 188 549 3

- Bet 188 550 3

- Bet 188 591 3

- Bet 188 700 3

- Bet 188 769 3

- Bet 188 848 3

- Bet 188 997 3

- Bet 188 Link 136 3

- Bet 188 Link 172 1

- Bet 188 Link 551 1

- Bet 188 Link 845 3

- Bet 188 Login 460 3

- Bet 20 107 3

- Bet 20 218 3

- Bet 20 247 3

- Bet 20 310 3

- Bet 20 404 1

- Bet 20 530 3

- Bet 20 58 3

- Bet 20 615 3

- Bet 20 646 3

- Bet 20 83 3

- Bet 20 927 3

- Bet 20 963 3

- Bet 20 App 168 1

- Bet 20 App 690 1

- Bet 20 App 699 3

- Bet 20 App 744 3

- Bet F12 917 3

- Bet Online Safe 425 1

- Bet Riot 408 3

- Bet Riot 647 2

- Bet Riot 814 3

- Bet Riot Login 221 3

- Bet Riot Login 419 3

- Bet Riot Login 517 3

- Bet Riot Login 549 3

- Bet Riot Login 966 3

- Bet Safe Bet 990 3

- Bet Safe Casino 732 3

- Bet Safe Casino 971 3

- Bet Safe Kasyno 142 3

- bet1 2

- bet2 2

- Bet20 388 3

- Bet20 893 3

- bet3 1

- Bet365 Calcio 50 3

- Bet365 Live 848 3

- Bet365 Live 887 3

- Bet365 Login 685 3

- Bet365 Poker App 174 3

- Bet365 Scommesse 36 3

- bet4 1

- Betani 237 3

- Betano Aposta 875 3

- Betano App 202 3

- Betano Entrar 22 3

- Betano Login Entrar Na Minha Conta 418 3

- Betano Login Entrar Na Minha Conta 420 1

- Betboo Canli 788 3

- Betboo Guncel 585 1

- Betboo Guncel 99 3

- Betboo Indir 19 3

- Betery Bet 709 3

- Betfiery Login 42 3

- Betflag Accedi 982 1

- Betflag Casino Login 716 3

- Betmexico App 742 3

- Betmexico Casino En Linea 308 2

- Betnacional Apk 723 3

- Betnacional Aviator Baixar 955 3

- Betnacional Baixar Android 843 3

- Betnacional Oficial Entrar 902 3

- Betonred Casino Login 585 3

- Betonred Sport 714 3

- Betpix App 559 3

- Betpix Futebol 539 3

- Betpremium Bonus Benvenuto 508 2

- Betpremium Bonus Benvenuto 886 1

- Betpremium Scommesse 165 3

- Betriot App 378 3

- Betriot App 451 3

- Betriot App 716 3

- Betriot App 77 3

- Betriot App 950 3

- Betriot Bonus 403 3

- Betriot Bonus 695 2

- Betriot Bonus 766 1

- Betriot Bonus 84 3

- Betriot Casino 665 3

- Betriot Casino 953 3

- Betriot Casino Italy 196 3

- Betriot Casino Italy 340 3

- Betriot Casino Italy 479 3

- Betriot Casino Italy 517 2

- Betriot Casino Italy 748 1

- Betriot Casino Italy 790 3

- Betriot Casino Italy 870 3

- Betriot Casino Italy 872 3

- Betriot Casino Login 125 3

- Betriot Casino Login 422 3

- Betriot Casino Login 53 3

- Betriot Casino Login 686 3

- Betriot Casino Login 807 3

- Betriot Casino Login 894 3

- Betriot No Deposit 211 3

- Betriot No Deposit 231 3

- Betriot No Deposit 424 3

- Betriot Online 119 1

- Betriot Online 130 3

- Betriot Online 144 3

- Betriot Online 832 3

- Betriot Online 838 3

- Betriot Online 846 3

- Betriot Recensioni 407 3

- Betriot Recensioni 583 3

- Betriot Recensioni 663 3

- Betriot Recensioni 771 3

- Betsafe Bet 118 3

- Betsafe Bonus 665 3

- Betsafe Casino Slots 320 3

- Betsafe Casinos 780 3

- Betsafe Deposit 456 3

- Betsafe Free Bonus 61 3

- Betsafe Free Spins 785 3

- Betsafe Kasino 145 2

- Betsafe Kasino 621 3

- Betsafe Kazino 256 3

- Betsafe Online 766 3

- Betsafe Online Poker 986 3

- Betsafe Pl 963 3

- Betsafe Roulette 151 3

- Betsafe Roulette 588 3

- Betsafe Roulette 823 3

- Betsafe Roulette 874 3

- Betsafe Site 390 3

- Betsafe Slots 252 2

- Betsafe Slots 734 3

- Better Lottomatica 396 3

- Betting 1

- betwinner1 2

- betwinner2 1

- bezopasnyirepost.com 20 1

- Bgame Poker 610 3

- Big Casino Snai App 162 3

- Bison Casino Aplikacja 282 3

- Bison Casino Aplikacja 679 3

- Bison Casino Kod Promocyjny 59 3

- Bison Casino Kod Promocyjny 88 3

- Bison Kasyno 200 1

- Bitcoin Network Fee 351 2

- Bizzo Casino 249 3

- Bizzo Casino App 940 3

- Bizzo Casino Bonus 194 3

- Bizzo Casino Bonus 276 3

- Bizzo Casino Bonus 29 3

- Bizzo Casino Bonus 314 1

- Bizzo Casino Bonus 329 3

- Bizzo Casino Bonus 344 3

- Bizzo Casino Bonus 351 1

- Bizzo Casino Bonus 406 1

- Bizzo Casino Bonus 409 3

- Bizzo Casino Bonus 418 3

- Bizzo Casino Bonus 425 3

- Bizzo Casino Bonus 453 3

- Bizzo Casino Bonus 456 3

- Bizzo Casino Bonus 466 3

- Bizzo Casino Bonus 553 3

- Bizzo Casino Bonus 568 3

- Bizzo Casino Bonus 620 1

- Bizzo Casino Bonus 661 1

- Bizzo Casino Bonus 671 2

- Bizzo Casino Bonus 741 3

- Bizzo Casino Bonus 747 2

- Bizzo Casino Bonus 788 3

- Bizzo Casino Bonus 793 3

- Bizzo Casino Bonus 807 3

- Bizzo Casino Bonus 813 2

- Bizzo Casino Bonus 871 3

- Bizzo Casino Bonus 880 3

- Bizzo Casino Bonus 93 3

- Bizzo Casino Bonus Code 101 3

- Bizzo Casino Bonus Code 135 3

- Bizzo Casino Bonus Code 196 3

- Bizzo Casino Bonus Code 359 3

- Bizzo Casino Bonus Code 388 3

- Bizzo Casino Bonus Code 416 3

- Bizzo Casino Bonus Code 44 1

- Bizzo Casino Bonus Code 496 1

- Bizzo Casino Bonus Code 578 3

- Bizzo Casino Bonus Code 695 1

- Bizzo Casino Bonus Code 759 3

- Bizzo Casino Bonus Code 827 3

- Bizzo Casino Bonus Code 83 1

- Bizzo Casino Bonus Code 907 3

- Bizzo Casino It 243 3

- Bizzo Casino It 33 3

- Bizzo Casino It 382 3

- Bizzo Casino It 390 3

- Bizzo Casino Login 114 3

- Bizzo Casino Login 613 3

- Bizzo Casino Login 812 2

- Bizzo Casino Online 134 3

- Bizzo Casino Pl 11 3

- Bizzo Casino Pl 110 3

- Bizzo Casino Pl 19 3

- Bizzo Casino Pl 230 3

- Bizzo Casino Pl 53 3

- Bizzo Casino Pl 608 3

- Bizzo Casino Pl 673 1

- Bizzo Casino Pl 716 3

- Bizzo Casino Pl 744 3

- Bizzo Casino Pl 8 3

- Bizzo Casino Pl 86 3

- Bizzo Casino Pl 912 3

- Bizzo Casino Promo Code 134 3

- Bizzo Casino Promo Code 151 3

- Bizzo Casino Promo Code 185 1

- Bizzo Casino Promo Code 299 3

- Bizzo Casino Promo Code 385 3

- Bizzo Casino Promo Code 410 3

- Bizzo Casino Promo Code 594 2

- Bizzo Casino Promo Code 681 3

- Bizzo Casino Promo Code 705 3

- Bizzo Casino Promo Code 846 3

- Bizzo Casino Promo Code 966 3

- Bizzo Casino Recensioni 811 1

- Bizzocasino 710 3

- Blaze Apostas Online 100 3

- Blaze Crash 961 3

- blog 179

- Bmw Casino Site 236 3

- Bmw Online Casino 135 6

- Bmw Online Casino 210 3

- Bmw Online Casino 665 2

- Bmw Slot Casino 484 1

- Bongobongo Zambia 28 3

- Bono Gratogana 36 3

- Bono Olybet 546 3

- Bonus 888 Starz 29 3

- Bonus 888 Starz 782 3

- Bonus 888starz 277 3

- Bonus Bez Depozytu Ggbet 946 3

- Bonus Code Ggbet 132 3

- Bonus De 20 No Cadastro Bet 417 3

- Bonus Ggbet 594 3

- Bonus Pagbet 756 3

- Bookkeeping 30

- Boomerang Bet Casino 255 3

- Brabet App 586 1

- Brabet Bet 809 1

- brautzauber-darmstadt.de 1

- bundekfest.hr 2

- Business 2

- camposchicken.pe 2

- Canli Mac Izle Jokerbet 468 1

- Canli Mac Izle Jokerbet 660 3

- Car Service 322 1

- Car Service 763 2

- Car Service 859 1

- Car Service 868 3

- Casino 193

- Casino 1win 601 3

- Casino 1win 684 3

- Casino 1win 793 3

- Casino 20 Euros Gratis Sin Deposito Por Registrar 10 Bet 380 3

- Casino 20 Euros Gratis Sin Deposito Por Registrar 10 Bet 440 3

- Casino 20bet 192 2

- Casino 888starz 671 3

- Casino 888starz 83 3

- Casino 888starz 907 3

- Casino Betsafe 220 3

- Casino Betsafe 49 1

- Casino Big 866 3

- Casino Bison 165 3

- Casino Bison 351 3

- Casino Days Mobile 887 3

- Casino Days No Deposit 50 Free Spins 883 3

- Casino Days No Deposit Bonus 20 3

- Casino Energy 636 3

- Casino Energy 845 3

- Casino Energy 939 3

- Casino Jackpot Bob 218 3

- Casino Lemon 362 3

- Casino Lemon 464 3

- Casino Lemon 94 1

- Casino Limitless 956 2

- Casino Limitless 974 1

- Casino Luxury 10 3

- Casino Luxury 874 1

- Casino Mcw 175 3

- Casino Mcw 348 3

- Casino Nv 44 1

- Casino Nv 816 3

- Casino Party 71 3

- Casino Pin Up 709 1

- Casino Rewards Yukon Gold 630 1

- Casino Vulkan Vegas 873 3

- Casino Vulkan Vegas 988 3

- Casino Wanabet 561 1

- Casino Wanabet 887 3

- Casino Yabby 264 3

- Casino Yukon Gold 935 3

- Casino Zodiac 220 6

- Casino Zodiac 273 3

- Casino Zodiac 33 3

- Casino1 6

- casino101 1

- casino102 1

- casino103 1

- casino2 6

- casino201 1

- casino202 1

- casino203 1

- casino241 1

- casino242 2

- casino25 1

- casino27 1

- casino3 5

- casino4 2

- casino5 1

- casino6 1

- casino7 1

- Casino770 Mon Compte 71 3

- Casino770 Mon Compte 754 2

- Casino770 Promotions 405 2

- Casinodays Login 776 3

- casinofaenger 1

- Casinomania App 147 3

- Casinomania App 649 3

- Casinomania Bonus Senza Deposito 817 1

- casinos1 1

- Cassino Betano 21 3

- cccituango.co 14000 1

- CH 3

- chat bot names 4 1

- Chicken Cross Gambling Game 489 3

- Chicken Cross Game Money 462 3

- Chicken Crossing Road Gambling Game 693 3

- Chicken Road Casino 550 3

- Chicken Road Cross Game 196 3

- Chicken Road Gambling Game 697 3

- Chicken Road Gambling Game 742 3

- Chicken Road Game 606 3

- Chicken Road Game 689 1

- Chicken Road Opiniones 668 3

- CIB 3

- ciroblazevic.hr 1

- cityoflondonmile3 1

- cityoflondonmile4 1

- Clubhouse Casino Login 692 3

- Clubhouse Casino No Deposit Bonus 113 1

- Codigo Bonus Betano Gratis 958 3

- comchay.de 1

- Como Ganhar No Aviator Betnacional 314 3

- Como Jogar Aviator No Betnacional 507 3

- Cosmo Casino Login Nz 932 1

- Cosmo Casino Sign Up 402 3

- Crickex Login 469 3

- Crickex Login 772 3

- Cryptocurrency exchange 4

- csri-sc.org 1

- Czy Total Casino Jest Legalne 231 3

- Dang Nhap 8xbet 170 3

- Dang Nhap 8xbet 457 2

- Dang Nhap 8xbet 645 3

- Dang Nhap 8xbet 739 3

- Dang Nhap 8xbet 946 4

- Dang Nhap Bet 188 599 3

- Dang Nhap Bet 188 85 1

- Darmowe Spiny Energycasino 241 1

- Darmowe Spiny Energycasino 558 1

- Darmowe Spiny Energycasino 827 3

- Darmowe Spiny Energycasino 92 3

- degredachile.com 2

- Delivery Service 255 2

- Demo Slot Jili 244 1

- Demo Slot Jili 547 3

- Demo Slot Jili 737 3

- Demo Slot Jili 890 3

- Descargar 22bet 219 3

- Descargar 22bet 648 3

- Design 1

- developmentspb.ru 10 1

- digitaleconomy.world 20 1

- dobravina.hr 1

- dormitan.es 3

- Download Eurobet 224 1

- Download Linebet Apk 701 3

- drivein.hr 1

- dukatzabanovinu.hr 1

- EC 3

- ecomenergia.cl 1

- edosszie.hu2 1

- edu-alania.ru 36 1

- Ekbet App 299 3

- Ekbet Deposit 773 2

- Ekbet Login Mobile 78 3

- elagentecine.cl 5

- Energi Casino 389 3

- Energi Casino 488 3

- Energi Casino 962 3

- Energy Casino 31 3

- Energy Casino 48 3

- Energy Casino 698 3

- Energy Casino 831 3

- Energy Kasyno 173 3

- Energy Kasyno 201 3

- Energy Kasyno 963 3

- Energy Kasyno 975 3

- Energycasino Bonus 224 3

- Energycasino Bonus 274 3

- Energycasino Bonus 958 3

- Energycasino Bonus Bez Depozytu 721 3

- Energycasino Free Spin 520 3

- Energycasino Free Spin 852 3

- Energycasino Kod Promocyjny 101 3

- Energycasino Kod Promocyjny 644 3

- Energycasino No Deposit Bonus 252 3

- Energycasino No Deposit Bonus 566 3

- Energycasino Pl 294 3

- Energycasino Pl 370 3

- Energycasino Pl 446 3

- Energycasino Pl 889 3

- Energycasino Promo Code 230 1

- Energycasino Promo Code 4 3

- Energycasino Promo Code 486 3

- Energycasino Promo Code 573 3

- Energycasino Promo Code 700 3

- Energycasino Promo Code 799 3

- Energykasyno 565 3

- Energykasyno 906 1

- Eurobet App Download Android 389 3

- Eurobet Live 631 3

- Excursions 13 2

- F12 Bet Apk 59 3

- F12 Bet Entrar 240 3

- F12 Bet Login 809 2

- F12bet Baixar App 708 1

- f1point0.com 1

- Fada 888 Casino 301 3

- Fairplay 24 812 1

- Fairplay Betting App 437 3

- Fairplay Live Login 550 2

- Fairplay Login Id Sign Up 206 2

- Fan Bet 89 3

- Fansbet Bonus Code 918 3

- Fansbet Promo Code 108 9

- Fantasy Bet 42 3

- Fantasy Bet 552 1

- Fantasy Scommesse 181 3

- farma3 1

- farmacia2 1

- Fashion 3

- Fast Bet 724 2

- Fastbet App 137 3

- Fastbet App 746 1

- Fastbet Bonus Benvenuto 149 3

- Fastbet Bonus Benvenuto 293 3

- Fastbet360 166 3

- Fatboss Bonus 934 3

- Fatboss Casino 431 3

- Fb 777 385 1

- Fb 777 560 1

- Fb 777 796 3

- Fb 777 864 3

- Fb 777 912 3

- Fb 777 986 2

- Fb 777 Casino 833 1

- Fb 777 Casino Login 14 3

- Fb 777 Casino Login 161 3

- Fb 777 Casino Login 209 3

- Fb 777 Casino Login 232 3

- Fb 777 Casino Login 736 3

- Fb 777 Casino Login 808 3

- Fb 777 Casino Login 963 2

- Fb 777 Login 133 1

- Fb 777 Login 599 1

- Fb 777 Login 699 3

- Fb777 App 502 3

- Fb777 Casino 758 1

- Fb777 Live 16 3

- Fb777 Live 541 3

- Fb777 Live 576 1

- Fb777 Login 121 3

- Fb777 Login 873 3

- Fb777 Pro 26 3

- Fb777 Pro 419 3

- Fb777 Pro 577 3

- Fb777 Pro Login 381 3

- Fb777 Pro Login 502 1

- Fb777 Pro Login 664 1

- Fb777 Pro Login 702 1

- Fb777 Pro Login 752 2

- Fb777 Pro Login 936 3

- Fb777 Register Login 701 3

- Fb777 Register Login 839 3

- Fb777 Register Login 859 1

- Fb777 Register Login 991 3

- Fb777 Slot Casino 21 3

- Fb777 Slot Casino 668 3

- Fb777 Slot Casino 717 1

- Fb777 Slots 174 3

- Fb777 Slots 266 3

- Fb777 Slots 325 3

- Fb777 Vip Login Registration 175 3

- Fb777 Vip Login Registration 289 3

- Fb777 Vip Login Registration 433 3

- Fb777 Vip Login Registration 542 3

- Fb777 Vip Login Registration 71 3

- Fb777 Vip Login Registration 717 3

- Fb777 Vip Login Registration 910 3

- Fb777 Win 123 3

- Fb777 Win 146 3

- feelyourbody.ru 120 1

- Festivals 1

- FinTech 1

- fiser.es 1

- Forex Trading 8

- Fortune Gems Online 152 3

- Fortune Gems Online 822 3

- Fortune Gems Online 905 2

- Fortune Gems Online 920 3

- Fortune Gems Online Casino 107 3

- Fortune Gems Online Casino 305 3

- Fortune Gems Online Casino 479 3

- Fortune Gems Slot 634 2

- Fortune Gems Slot 97 3

- Fortune Gems Win 278 3

- Fortune Gems Win 435 3

- Fortune Gems Win 602 3

- Free Spin Casino 104 3

- Free Spin Casino 140 3

- Free Spin Casino 187 2

- Free Spin Casino 242 3

- Free Spin Casino 270 3

- Free Spin Casino 434 3

- Free Spin Casino 64 3

- Free Spin Casino 791 1

- Free Spin Casino 944 3

- fysiotek.gr 1

- Galactic Wins Bonus Code 918 3

- Galactic Wins Casino 690 3

- Galactic Wins Casino Login 831 3

- Galactic Wins Casino Login 91 3

- Galactic Wins Casino No Deposit Bonus 511 3

- Galactic Wins Casino Review 493 3

- Galactic Wins Free Spins 161 3

- Galactic Wins Free Spins 593 3

- Galactic Wins Free Spins 918 2

- Galactic Wins Login 183 6

- Galactic Wins Login 593 3

- Galactic Wins Login 595 3

- Galactic Wins No Deposit 358 3

- Galactic Wins No Deposit Bonus 666 3

- Galactic Wins No Deposit Bonus 888 3

- Galactic Wins No Deposit Bonus Codes 25 3

- Galactic Wins No Deposit Bonus Codes 367 3

- Galactic Wins No Deposit Bonus Codes 745 1

- Gamdom Casino 902 3

- Gamdom Deutschland 103 3

- gate-of-olympus.gr 2

- Gbg Bet Download 579 3

- Gbg Bet Login 404 3

- general 11

- Gg Bet 115 3

- Gg Bet Bonus 199 1

- Gg Bet Bonus 743 2

- Gg Bet Bonus 879 2

- Gg Bet Bonus 994 2

- Gg Bet Casino 180 3

- Gg Bet Casino 528 3

- Gg Bet Casino 628 1

- Gg Bet Casino 667 3

- Gg Bet Casino 794 1

- Gg Bet Casino 933 3

- Gg Bet Login 124 3

- Gg Bet Login 162 3

- Gg Bet Login 908 3

- Gg Bet Polska 105 3

- Gg Bet Polska 311 3

- Gg Bet Polska 400 3

- Gg Bet Polska 727 1

- Gg Bet Polska 89 3

- Ggbet 50fs 57 3

- Ggbet Casino 24 3

- Ggbet Casino 626 3

- Ggbet Casino 709 3

- Ggbet Casino 859 3

- Ggbet Casino 997 1

- Ggbet Esports 338 3

- Ggbet Esports 82 3

- Ggbet Free Slots 516 3

- Ggbet Free Slots 672 3

- Ggbet Free Slots 888 1

- Ggbet Free Spin 556 3

- Ggbet Kasyno 348 3

- Ggbet Kasyno 743 2

- Ggbet Kasyno 750 2

- Ggbet Logowanie 427 3

- Ggbet Logowanie 699 3

- Ggbet Logowanie 729 3

- Ggbet Pl 959 3

- Ggbet Polska 493 3

- Goldbet App 714 3

- Grandwin Casino 294 1

- Grandwin Online Casino 569 2

- Grato Gana 732 3

- Gratogana Bono 36 3

- Gratogana Casino 479 2

- Gratogana Opiniones 192 3

- Gratowin Casino 357 3

- Gratowin Casino Login 569 3

- greekgirlscode.com 1

- grodno.staybook.by 1

- Gully Bet App 106 3

- Gym 753 2

- Happy Bet 188 931 3

- Hell On Wheels Spin Off 134 3

- Hell On Wheels Spin Off 225 3

- Hell On Wheels Spin Off 253 3

- Hell On Wheels Spin Off 322 3

- Hell On Wheels Spin Off 742 3

- Hell On Wheels Spin Off 775 3

- Hell On Wheels Spin Off 843 3

- Hell Spin 1 Deposit 177 3

- Hell Spin 158 3

- Hell Spin 173 3

- Hell Spin 22 206 3

- Hell Spin 22 468 3

- Hell Spin 22 563 1

- Hell Spin 22 926 3

- Hell Spin 34 3

- Hell Spin 450 3

- Hell Spin 520 3

- Hell Spin 887 3

- Hell Spin 947 3

- Hell Spin Bonus 47 1

- Hell Spin Bonus 73 3

- Hell Spin Bonus 954 3

- Hell Spin Bonus Bez Depozytu 139 3

- Hell Spin Bonus Bez Depozytu 336 1

- Hell Spin Bonus Bez Depozytu 544 3

- Hell Spin Bonus Bez Depozytu 616 3

- Hell Spin Bonus Bez Depozytu 69 3

- Hell Spin Bonus Code 447 3

- Hell Spin Bonus Code 451 3

- Hell Spin Casino 185 2

- Hell Spin Casino 201 3

- Hell Spin Casino 28 1

- Hell Spin Casino 376 3

- Hell Spin Casino 393 3

- Hell Spin Casino 418 6

- Hell Spin Casino 426 3

- Hell Spin Casino 50 3

- Hell Spin Casino 503 3

- Hell Spin Casino 516 3

- Hell Spin Casino 71 3

- Hell Spin Casino 753 2

- Hell Spin Casino 975 3

- Hell Spin Casino Erfahrungen 264 3

- Hell Spin Casino No Deposit Bonus 126 3

- Hell Spin Casino No Deposit Bonus 203 3

- Hell Spin Casino No Deposit Bonus 207 3

- Hell Spin Casino No Deposit Bonus 432 3

- Hell Spin Casino No Deposit Bonus 631 3

- Hell Spin Casino No Deposit Bonus 632 3

- Hell Spin Casino No Deposit Bonus 892 3

- Hell Spin Casino No Deposit Bonus 904 3

- Hell Spin Free Spins 355 3

- Hell Spin Free Spins 655 3

- Hell Spin Free Spins 831 3

- Hell Spin Free Spins 903 3

- Hell Spin Kasyno 132 3

- Hell Spin Kasyno 210 3

- Hell Spin No Deposit 220 3

- Hell Spin No Deposit 63 3

- Hell Spin No Deposit 825 3

- Hell Spin No Deposit Bonus 611 3

- Hell Spin No Deposit Bonus 62 3

- Hell Spin No Deposit Bonus 641 3

- Hell Spin Opinie 644 3

- Hell Spin Promo Code 176 3

- Hell Spin Promo Code 248 3

- Hell Spin Promo Code 335 3

- Hell Spin Promo Code 475 3

- Hell Spin Promo Code 488 1

- Hell Spin Promo Code 567 3

- Hell Spin Promo Code 59 3

- Hell Spin Promo Code 724 3

- Hell Spin Promo Code 732 2

- Hell Spin Promo Code 912 3

- Hell Spin Promo Code 927 3

- Hellspin 90 520 3

- Hellspin 90 588 3

- Hellspin 90 671 2

- Hellspin 90 790 3

- Hellspin 90 904 3

- Hellspin 90 967 3

- Hellspin 90 998 1

- Hellspin App 190 3

- Hellspin App 289 3

- Hellspin App 480 1

- Hellspin App 935 2

- Hellspin Australia 366 3

- Hellspin Australia 497 3

- Hellspin Australia 769 3

- Hellspin Australia 916 1

- Hellspin Australia 948 3

- Hellspin Australia 978 1

- Hellspin Australia 988 1

- Hellspin Bonus 339 3

- Hellspin Bonus 5 1

- Hellspin Bonus Bez Depozytu 324 1

- Hellspin Bonus Bez Depozytu 35 3

- Hellspin Bonus Bez Depozytu 42 3

- Hellspin Bonus Bez Depozytu 464 3

- Hellspin Bonus Bez Depozytu 689 1

- Hellspin Bonus Bez Depozytu 736 3

- Hellspin Bonus Bez Depozytu 836 3

- Hellspin Bonus Code 232 2

- Hellspin Bonus Code 744 3

- Hellspin Bonus Code 75 3

- Hellspin Bonus Code 886 3

- Hellspin Bonus Code Australia 203 3

- Hellspin Bonus Code Australia 41 3

- Hellspin Bonus Code Australia 760 3

- Hellspin Bonus Code No Deposit 369 3

- Hellspin Casino 150 3

- Hellspin Casino 162 3

- Hellspin Casino 176 1

- Hellspin Casino 21 1

- Hellspin Casino 210 3

- Hellspin Casino 319 3

- Hellspin Casino 388 3

- Hellspin Casino 402 3

- Hellspin Casino 472 3

- Hellspin Casino 51 3

- Hellspin Casino 592 3

- Hellspin Casino 618 3

- Hellspin Casino 632 3

- Hellspin Casino 716 3

- Hellspin Casino 769 3

- Hellspin Casino 80 3

- Hellspin Casino 833 3

- Hellspin Casino 914 3

- Hellspin Casino App 211 3

- Hellspin Casino App 367 3

- Hellspin Casino App 579 1

- Hellspin Casino App 879 3

- Hellspin Casino Australia 243 2

- Hellspin Casino Australia 725 3

- Hellspin Casino Australia 96 3

- Hellspin Casino Australia 971 3

- Hellspin Casino Erfahrungen 555 2

- Hellspin Casino Login 312 3

- Hellspin Casino Login 331 3

- Hellspin Casino Login 40 3

- Hellspin Casino Login 463 3

- Hellspin Casino Login 480 3

- Hellspin Casino Login 60 3

- Hellspin Casino Login 643 3

- Hellspin Casino Login 715 3

- Hellspin Casino Login 762 3

- Hellspin Casino Login 824 3

- Hellspin Casino Login 986 2

- Hellspin Casino Login Australia 170 3

- Hellspin Casino Login Australia 276 3

- Hellspin Casino Login Australia 499 3

- Hellspin Casino Login Australia 552 3

- Hellspin Casino Login Australia 655 1

- Hellspin Casino Login Australia 675 1

- Hellspin Casino Login Australia 853 3

- Hellspin Casino No Deposit Bonus 221 3

- Hellspin Casino No Deposit Bonus 41 3

- Hellspin Casino No Deposit Bonus 738 1

- Hellspin Casino No Deposit Bonus 832 2

- Hellspin Casino No Deposit Bonus 889 3

- Hellspin Casino No Deposit Bonus 932 3

- Hellspin Casino No Deposit Bonus Codes 117 1

- Hellspin Casino No Deposit Bonus Codes 139 1

- Hellspin Casino No Deposit Bonus Codes 205 3

- Hellspin Casino Review 199 3

- Hellspin Casino Review 202 3

- Hellspin Casino Review 274 3

- Hellspin Casino Review 284 1

- Hellspin Casino Review 344 3

- Hellspin Casino Review 421 3

- Hellspin Casino Review 448 3

- Hellspin Casino Review 557 3

- Hellspin Casino Review 749 3

- Hellspin Casino Review 842 3

- Hellspin Casino Review 875 3

- Hellspin Casino Review 876 1

- Hellspin Casino Review 937 3

- Hellspin Cz 482 3

- Hellspin Kasyno 246 1

- Hellspin Kasyno 315 3

- Hellspin Kasyno 4 3

- Hellspin Kasyno 419 3

- Hellspin Kasyno 613 3

- Hellspin Kasyno 65 3

- Hellspin Kasyno 787 3

- Hellspin Kasyno 984 1

- Hellspin Kod Bonusowy 558 3

- Hellspin Kod Bonusowy 730 3

- Hellspin Kod Bonusowy 756 3

- Hellspin Kod Bonusowy 760 3

- Hellspin Kod Bonusowy 825 3

- Hellspin Kod Bonusowy Bez Depozytu 606 3

- Hellspin Kod Bonusowy Bez Depozytu 651 1

- Hellspin Kod Bonusowy Bez Depozytu 954 3

- Hellspin Kod Promocyjny 954 3

- Hellspin Login 116 3

- Hellspin Login 165 2

- Hellspin Login 274 3

- Hellspin Login 290 3

- Hellspin Login 356 3

- Hellspin Login 401 3

- Hellspin Login 473 3

- Hellspin Login 515 3

- Hellspin Login 593 1

- Hellspin Login 74 2

- Hellspin Login 772 3

- Hellspin Login 810 3

- Hellspin Login 929 3

- Hellspin Logowanie 135 3

- Hellspin Logowanie 280 3

- Hellspin Logowanie 4 3

- Hellspin Logowanie 416 3

- Hellspin Logowanie 764 3

- Hellspin Logowanie 81 3

- Hellspin Logowanie 961 3

- Hellspin No Deposit Bonus 52 3

- Hellspin No Deposit Bonus 784 3

- Hellspin No Deposit Bonus Codes 2024 412 3

- Hellspin No Deposit Bonus Codes 2024 673 3

- Hellspin No Deposit Bonus Codes 2024 749 3

- Hellspin Norge 767 3

- Hellspin Norge 833 3

- Hellspin Nz 498 3

- Hellspin Nz 771 3

- Hellspin Opinie 692 1

- Hellspin Pl 510 1

- Hellspin Pl 816 3

- Hellspin Promo Code 151 3

- Hellspin Promo Code 217 3

- Hellspin Promo Code 281 3

- Hellspin Promo Code 332 6

- Hellspin Promo Code 499 2

- Hellspin Promo Code 559 2

- Hellspin Promo Code 964 3

- Hellspin Promo Code No Deposit 235 3

- Hellspin Reviews 6 3

- Help Slot Win Jili 198 1

- Help Slot Win Jili 501 3

- Help Slot Win Jili 894 2

- Hit N Spin Casino 837 3

- Hit Spin 162 3

- Hitnspin Bonus Code 107 3

- Hitnspin Casino 145 3

- Hitnspin Casino 687 3

- Hitnspin Deutschland 221 3

- Hitnspin Deutschland 63 3

- Hitnspins 41 1

- hooplacomputer.hu 1

- hospicehomejc.org 1

- Hot 12play 633 1

- How To Create Crypto Wallet 811 3

- httpstecnatox.catmejores-casinos-online 1

- Ice Casino Aplikacja 470 3

- Ice Casino Aplikacja 481 3

- Ice Casino Aplikacja 856 3

- Ice Casino Bonus 361 3

- Ice Casino Bonus 956 3

- Ice Casino Gry Za 1 Gr 248 3

- Ice Casino Gry Za 1 Gr 76 3

- Ice Casino Login 7 3

- Ice Casino Logowanie 192 3

- Ice Casino Logowanie 931 2

- Ice Casino Logowanie 967 3

- Ice Casino Zaloguj 286 3

- Ice Casino Zaloguj 778 2

- Ice Kasyno 874 3

- Ice Kasyno Logowanie 187 1

- Ice Kasyno Logowanie 570 3

- Icecasino 453 3

- Icekasyno 16 3

- Icekasyno 171 3

- icestupa2 1

- icestupa3 1

- icestupa5 1

- icestupa7 1

- icestupa9 1

- igry-nardy.ru 4-8 1

- Indonsia Slot Gacor 1

- Indonsia Slot Gacor2 1

- infomelipilla.cl 1

- IronWallet Turkiye 875 1

- Is Hellspin Legit 17 3

- Is Hellspin Legit 673 3

- jabukatv.hr 1

- Jackpot Casino 551 3

- Jackpot Piraten 901 3

- Jackpotcity 10 2

- Jackpotpirate 985 3

- Jackpotpiraten Bonus Code 627 1

- Jackpotpiraten Bonus Code 832 3

- Jackpotpiraten Casino 133 3

- Jackpotpiraten De 133 3

- Jackpottpiraten 549 2

- Jak Wyplacic Pieniadze Z Ice Casino 205 3

- Jak Wyplacic Pieniadze Z Ice Casino 359 3

- Jalwa Game Download 259 3

- Jalwa Win Game 50 1

- jamiyatgzt.uz 1

- jaya91 1

- Jeetbuzz Affiliate App Download 969 3

- jellybag.pl 2

- Jeu Du Chicken 587 3

- Jili 777 Lucky Slot 235 3

- Jili 777 Lucky Slot 987 3

- Jili Slot 777 150 3

- Jili Slot 777 155 3

- Jili Slot 777 433 3

- Jili Slot 777 664 3

- Jili Slot 777 873 3

- Jili Slot 777 Login 190 3

- Jili Slot 777 Login 235 2

- Jili Slot 777 Login 53 3

- Jili Slot 777 Login 964 3

- Jili Slot 777 Login Register Online 245 3

- Jili Slot 777 Login Register Online 644 3

- Jili Slot 777 Login Register Online 730 2

- Jili Slot 777 Login Register Online 752 3

- Jili Slot 777 Login Register Philippines 265 3

- Jili Slot 777 Login Register Philippines 347 3

- Jili Slot 777 Login Register Philippines 947 3

- Jogo Dice Betfiery 501 3

- Jogo Do Aviator 467 3

- Jogo Onabet 515 3

- Joka Bet 491 3

- Jokabet Bonus Code 726 3

- Jokabet Espana 982 3

- Jokabet Login 844 3

- Jokerbet Giris 496 3

- Jokerbet Giris 776 3

- Jokerbet Giris 8 2

- Jokerbet Vip 114 3

- Jokerbet Vip 91 3

- jomboydon.uz 1

- Kasyno 888 Starz 729 3

- Kasyno 888starz 867 3

- Kasyno Betsafe 332 3

- Kasyno Hell Spin 465 3

- Kasyno Hellspin 754 2

- Kasyno Lemon 244 3

- Kasyno Lemon 731 1

- Kasyno Lemon 898 1

- Kasyno Nv 195 3

- Kasyno Nv 988 3

- Kasyno Slottica 703 3

- Kasyno Vulkan Vegas 419 3

- Kasyno Vulkan Vegas 545 3

- Kasyno Vulkan Vegas 595 1

- Kasyno Vulkan Vegas 643 3

- Kingdom Casino 936 3

- Kingdom Casino Login 166 3

- Kiwi Casino Games 97 3

- Kiwis Treasure Casino 794 3

- Kod Promocyjny Lemon Casino 642 3

- Kod Promocyjny Lemon Casino 970 3

- Kod Promocyjny Nv Kasyno 649 3

- kosi-restaurant.de 1

- krotam.net 1

- Kto Apostas Online 787 2

- Kto Bet 26 2

- Kto Casino 260 3

- Kto Entrar 412 3

- Kto Login Entrar 908 3

- Kudos Rewards 808 3

- Lala Bet Withdrawal 44 3

- Lalabet Casino App 557 3

- Lalabet Contact 143 3

- Lalabet Downloaden 724 3

- Lalabet Login 139 3

- Lalabet Login 340 3

- Lalabet Promo Code No Deposit 272 3

- Lampionsbet Do Tiringa 47 3

- Lampionsbet Dono 492 1

- Lemon Casino 50 Free Spins 209 3

- Lemon Casino 50 Free Spins 363 3

- Lemon Casino 50 Free Spins 425 3

- Lemon Casino 50 Free Spins 556 3

- Lemon Casino 50 Free Spins 814 2

- Lemon Casino 758 3

- Lemon Casino 895 3

- Lemon Casino Bonus 200 3

- Lemon Casino Bonus 322 3

- Lemon Casino Bonus 87 3

- Lemon Casino Bonus 922 1

- Lemon Casino Kod Promocyjny 259 3

- Lemon Casino Kod Promocyjny 324 3

- Lemon Casino Kod Promocyjny 558 2

- Lemon Casino Kod Promocyjny 656 3

- Lemon Casino Kod Promocyjny Bez Depozytu 74 1

- Lemon Casino Kod Promocyjny Bez Depozytu 82 3

- Lemon Casino Kod Promocyjny Bez Depozytu 908 3

- Lemon Casino Kod Promocyjny Bez Depozytu 958 3

- Lemon Casino Opinie 307 3

- Lemon Casino Pl 826 2

- Lemon Casino Pl 834 3

- Lemon Casino Promo Code 452 3

- Lemon Casino Promo Code 779 3

- Lemon Casino Promo Code 791 3

- Lemon Kasyno 231 3

- Lemon Kasyno 396 3

- Lemon Kasyno 931 3

- Lemon Kasyno Logowanie 294 3

- Lemon Kasyno Logowanie 401 3

- Lemon Kasyno Logowanie 850 3

- Lemonkasyno 294 1

- Lemonkasyno 464 2

- Lemonkasyno 783 3

- Lemonkasyno 808 1

- Lemonkasyno 823 3

- Lemonkasyno 839 1

- Lemonkasyno 976 3

- Lemonkasyno 986 3

- Level Up Casino App 307 2

- Level Up Casino App 627 3

- Level Up Casino App Download 887 3

- Level Up Casino Australia Login 649 2

- Level Up Casino Australia Login 910 1

- Level Up Casino Australia Login 987 1

- Level Up Casino Login 146 3

- Level Up Casino Login 626 3

- Level Up Casino Login 636 1

- Level Up Casino Login Australia 230 3

- Level Up Casino Login Australia 573 3

- Level Up Casino Login Australia 576 1

- Level Up Casino Login Australia 666 3

- Level Up Casino Login Australia 771 2

- Level Up Casino Sign Up 530 3

- Level Up Casino Sign Up 549 3

- Level Up Casino Sign Up 7 3

- Level Up Online Casino 203 3

- Level Up Online Casino 409 3

- Level Up Online Casino 602 3

- Level Up Online Casino 650 3

- Level Up Online Casino 88 3

- Levelup Casino 650 2

- Levelup Casino 700 3

- Levelup Casino App 48 3

- Levelup Casino App 554 1

- Levelup Casino App 572 1

- Levelup Casino App 759 3

- Levelup Casino App 877 2

- Levelup Casino Australia 110 3

- Levelupcasino 305 2

- Lex Casino 227 3

- Lex Casino App 941 3

- Lex Casino Erfahrungen 788 3

- Lex Casino No Deposit Bonus Code 599 3

- Lex Casino Promo Code 876 3

- Lex Online Casino 630 3

- Life Style 4

- Limitless Casino Log In 204 3

- Limitless Casino Log In 335 1

- Limitless Casino Sign Up 865 3

- Linebet Apps 559 3

- Link 188bet 375 6

- Link 188bet 999 1

- Link 188bet Moi Nhat 265 3

- Link 188bet Moi Nhat 519 1

- Link 188bet Moi Nhat 628 2

- Link 188bet Moi Nhat 881 3

- Link 188bet Moi Nhat 949 3

- Link Vao 188 Bet 120 6

- Link Vao 188 Bet 184 3

- Link Vao 188 Bet 237 3

- Link Vao 188 Bet 27 3

- Link Vao 188 Bet 305 2

- Link Vao 188 Bet 390 3

- Link Vao 188 Bet 48 2

- Link Vao 188 Bet 789 3

- Link Vao 188 Bet 840 3

- Link Vao 188 Bet 895 3

- Link Vao 188bet 572 3

- Link Vao 188bet 593 3

- Link Vao 188bet 617 3

- Link Vao 188bet 642 3

- Link Vao 188bet 77 2

- Link Vao 188bet 852 3

- Link Vao 188bet 915 2

- Link Vao 8xbet 176 3

- Link Vao 8xbet 259 3

- Link Vao 8xbet 52 3

- Link Vao 8xbet 597 3

- Link Vao 8xbet 968 3

- locallegendssydney.com 1

- Log In Luxury Casino Login 128 3

- logosstudy.ru 150 1

- Lucky Bird 486 3

- Lucky Bird Casino Login 113 3

- Lucky Bird Casino Login 159 3

- Lucky Bird Io 240 3

- Lucky Cola Casino Login 490 3

- Lucky Cola Casino Register 63 3

- Lucky Cola Online Casino 318 3

- Lucky Cola Slot Login 406 3

- Lucky Cola Slot Login 999 3

- Lucky Jet 1win 123 3

- Lucky Jet 1win 649 3

- lucysblueday.com 1

- Luva Bet App 201 1

- Luva Bet Download 237 3

- Luva De Pedreiro Bet 798 3

- Luxury Casino 50 Free Spins 3 3

- Luxury Casino 50 Free Spins 413 2

- Luxury Casino En Ligne 32 2

- Luxury Casino Online 410 3

- Luxury Casino Sign In 657 3

- Luxury Casino Sign In 699 3

- Magical Spin Avis 340 3

- Magical Spin Retrait 390 2

- Major Sport Baixar Aplicativo 931 3

- Marjosports App Baixar Gratis 722 3

- Marjosports Baixar 169 3

- marktkauf-shs.de 1

- Mcw Online Casino Philippines 328 3

- medweno.de 4

- mega168bet.com 1

- megancueros.pe 2

- metody-platnosci.pl 1

- Milky Way Casino Online 870 3

- Milky Way Online 147 2

- Milky Way Online Casino App 44 3

- Milky Way Online Casino App 844 3

- Milkyway Casino 820 3

- Milkyway Download 602 1

- Mines 20bet 963 3

- mininformrd.ru 36 1

- Monro-casino 1

- moon-princess-100.com 1

- Mostbet 30 Free Spins 698 3

- Mostbet App Bangladesh 338 3

- Mostbet Aviator 492 3

- Mostbet Aviator 518 3

- Mostbet Aviator App Download 297 3

- Mostbet Aviator Download 515 3

- Mostbet Bonus 331 3

- Mostbet Casino 445 3

- Mostbet Giris 991 3

- Mostbet Indir 656 2

- Mostbet Kazahstan 549 3

- Mostbet Kazino 912 3

- Mostbet Login Bangladesh 980 1

- Mostbet Login India 338 3

- Mostbet Login India 793 3

- Mostbet Online 199 3

- Mostbet Online 362 3

- Mostbet Registration 656 3

- Mostbet Review 745 3

- Mostbet Ua 78 3

- mostbet-oynash.org 1

- mostbetuzcasino.com 1

- Motorcycle Service 709 1

- Mr O Casino No Deposit Bonus 173 3

- Mr O Casino No Deposit Bonus 530 1

- Mro Casino Login 412 3

- munizagaballet.cl 1

- my-1xbet.com 1

- nationalnurse.org 1

- Netwin App 567 3

- Netwin Italia 150 3

- Netwin Slot 771 3

- News 275

- Nha Cai 8xbet 152 3

- Nha Cai 8xbet 260 3

- Nha Cai 8xbet 583 3

- Nha Cai 8xbet 794 3

- Nha Cai 8xbet 92 3

- Nn777 Slot Jili 211 3

- Nn777 Slot Jili 275 3

- Nn777 Slot Jili 485 3

- Nn777 Slot Jili 536 1

- Nn777 Slot Jili 734 1

- northbikepro.cl 1

- Nowe Kody Do Lemon Casino 513 3

- Nowe Kody Do Lemon Casino 848 1

- Nv Casino App 201 3

- Nv Casino App 370 3

- Nv Casino Bonus 119 3

- Nv Casino Bonus 762 3

- Nv Casino Code 358 3

- Nv Casino Code 417 3

- Nv Casino Code 584 3

- Nv Casino Code 85 3

- Nv Casino Code 893 3

- Nv Casino Code 969 3

- Nv Casino Login 448 3

- Nv Casino No Deposit Bonus 19 3

- Nv Casino No Deposit Bonus 705 3

- Nv Casino No Deposit Bonus 826 3

- Nv Casino No Deposit Bonus 987 3

- Nv Casino Online 397 3

- Nv Casino Online Login 457 3

- Nv Casino Opinie 496 3

- Nv Kasyno 20 Euro 254 2

- Nv Kasyno 20 Euro 570 3

- Nv Kasyno 20 Euro 649 3

- Nv Kasyno 20€ 279 3

- Nv Kasyno 20€ 530 3

- Nv Kasyno 20€ 553 3

- Nv Kasyno 20€ 738 3

- Nv Kasyno 20€ No Deposit Bonus 295 3

- Nv Kasyno 20€ No Deposit Bonus 58 3

- Nv Kasyno 20€ No Deposit Bonus 760 3

- Nv Kasyno 20€ No Deposit Bonus 805 3

- Nv Kasyno 931 3

- Nv Kasyno Apk 774 3

- Nv Kasyno Apk 843 3

- Nv Kasyno Logowanie 39 3

- Nv Kasyno Online 199 3

- Nv Kasyno Online 449 3

- Nv Kasyno Online 518 3

- Nv Kasyno Opinie 850 3

- Nv Kasyno Rejestracja 314 3

- Nv Kasyno Rejestracja 495 3

- Nv Kasyno Review 142 3

- Nv Kasyno Review 335 3

- Nv Kasyno Review 805 3

- Nv Online Casino 252 3

- Nv Online Casino 430 3

- Nvcasino 687 3

- Oba Bet Bonus De 20 31 3

- Olybet Apuestas 341 3

- Olybet Espana 309 3

- Olybet Espana 635 3

- Olybet Espana 742 3

- Olybet Opiniones 478 6

- Olybet Opiniones 776 3

- Olybet Opiniones 883 3

- Olybet Suertia 107 6

- Olybet Suertia 634 3

- omega-apartments.pt 1

- Omegle 18

- Omegle cc 18

- omitapparel 1

- Online Casino 6

- Opiniones Chicken Road 855 3

- other 10

- Pagbet Bonus 338 2

- palmeirasshopping.pt 1

- Paradise 8 Casino Login 652 3

- Paradise8 Casino 169 3

- Party Casino Login 732 3

- Party Casino Login 771 3

- Partycasino Casino 568 3

- Partycasino Casino 834 3

- patridiots.com 1

- pdrc 1

- Phlwin App 703 3

- Phlwin App Link 510 3

- Phlwin App Link 764 3

- Phlwin App Link 793 1

- Phlwin App Login 383 1

- Phlwin App Login 908 3

- Phlwin App Login 986 3

- Phlwin Bonus 428 3

- Phlwin Bonus 600 3

- Phlwin Bonus 744 2

- Phlwin Casino 128 3

- Phlwin Casino 244 2

- Phlwin Casino 557 3

- Phlwin Free 100 3 3

- Phlwin Free 100 323 3

- Phlwin Free 100 336 3

- Phlwin Free 100 350 2

- Phlwin Free 100 382 3

- Phlwin Free 100 669 2

- Phlwin Free 100 794 3

- Phlwin Free 100 879 3

- Phlwin Free 100 905 3

- Phlwin Free 100 No Deposit 165 3

- Phlwin Free 100 No Deposit 193 1

- Phlwin Free 100 No Deposit 310 3

- Phlwin Free 100 No Deposit 652 3

- Phlwin Free 100 No Deposit 806 3

- Phlwin Free 100 No Deposit 876 3

- Phlwin Free 100 No Deposit 961 3

- Phlwin Free 100 No Deposit Bonus 678 3

- Phlwin Free 200 616 1

- Phlwin Login 152 3

- Phlwin Login 201 3

- Phlwin Login 378 3

- Phlwin Login 397 3

- Phlwin Login 453 3

- Phlwin Login 688 3

- Phlwin Login 960 3

- Phlwin Mines Bomb 178 3

- Phlwin Mines Bomb 323 3

- Phlwin Mines Bomb 389 3

- Phlwin Mines Bomb 430 3

- Phlwin Mines Bomb 915 3

- Phlwin Mines Bomb 959 3

- Phlwin Online Casino 325 1

- Phlwin Online Casino 846 3

- Phlwin Online Casino Hash 111 3

- Phlwin Online Casino Hash 112 3

- Phlwin Online Casino Hash 398 2

- Phlwin Online Casino Hash 590 3

- Phlwin Online Casino Hash 800 3

- Phlwin Online Casino Hash 871 3

- Phlwin Ph 227 3

- Phlwin Ph 4 3

- Phlwin Register 349 3

- Photography 2

- Pin Up Casino Login 709 3

- Pin Up Login 15 3

- Pin Up Login 813 3

- pin-up-casino-login 1

- Pinup 558 3

- Pinup 865 3

- Pinup Bet 102 2

- Pinup Betting 219 3

- Pinup Betting 717 3

- pirs67.ru 50 1

- Pixbet Aposta Gratis 887 3

- Platincasino Espana 955 3

- Platincasino Login 318 3

- Platincasino Login 64 3

- Play Croco Australia 229 3

- Play Croco Australia 709 3

- Play Croco Casino Australia 674 3

- Playcroco App 458 3

- Plus 777 Slot 146 3

- Plus 777 Slot 599 4

- Plus 777 Slot 81 3

- Plus 777 Slot 892 1

- Plus 777 Slot 901 3

- pocketoption3 1

- Poker Betsafe 137 3

- poland 2

- POLAND – Copy 1

- POLAND – Copy – Copy 1

- POLAND – Copy – Copy (2 1

- polmaratonsolidarnosci.pl 1

- Post 161

- prensa24.cl 1

- primexbt1 1

- primexbt2 1

- primexbt3 1

- Promo Code Vai De Bet 546 3

- pulmix.ru 150 1

- Punto Scommesse Recensioni 344 3

- Punto Scommesse Recensioni 755 3

- Puntoscommesse Mobile 301 3

- Queen 777 Casino 47 3

- Queen 777 Casino 953 3

- Queen 777 Casino Login 264 3

- Queen 777 Casino Login Philippines 178 3

- Queen 777 Casino Login Philippines 624 3

- Queen 777 Casino Login Philippines 715 3

- Queen 777 Casino Login Register 898 3

- Queen 777 Login 358 3

- Queen777 App 86 3

- Queen777 Casino 473 3

- Queen777 Casino 547 3

- Queen777 Casino Login 593 2

- Queen777 Casino Login 701 3

- Queen777 Login 619 3

- Queen777 Register Login 219 3

- Queen777 Register Login 479 3

- rabonaonline.de 1

- ready_text 36

- Realsbet Bonus 201 3

- Realsbet Bonus 558 3

- Realsbet E Legalizado 234 3

- Registro F12 Bet 451 2

- restaurantearegaleira.pt 1

- Rhino Bet 667 3

- Rhino Bet App 741 2

- Rhino Bet Casino 14 3

- Rhino Bet Casino 329 3

- Rhino Bet Casino 351 3

- Rhino Bet Casino 445 2

- Rhino Bet Contact 301 3

- Rhino Bet Live Chat 438 3

- Rhino Bet Promo Code 45 3

- Rhino Bet Promo Code 487 3

- Rhino Bet Review 298 3

- Rhino Casino 63 3

- Rhinobet Slots 325 6

- rise-of-olympus-100.com.gr 1

- Rizk Casino 50 Free Spins No Deposit 147 3

- roobetitaly.com 1

- rosomed2020.ru 20 1

- Roulette Safe Bet 195 3

- Roulette Safe Bet 888 2

- Royal 888 Casino Register Login 598 3

- Royal Vegas 1 Deposit 184 3

- Royal Vegas Nz Login 127 3

- Royal Win Apk 956 2

- Royal Win Apk Download 940 3

- Royal Win App Download Apk 696 3

- Royal Win App Login 316 3

- Royalvegascasino 169 3

- Rt Bet 652 3

- Rt Bet 846 3

- Rt Bet Online 270 2

- Rt Bet Online 51 3

- Rt Bet Online 526 3

- Rtbet Bonus 464 3

- Rtbet Bonus 527 3

- Rtbet Casino 882 3

- Rtbet Casino 982 3

- Rtbet Casino It 214 3

- Rtbet Casino Login 330 3

- Rtbet Casino Login 413 3

- Rtbet Login 357 1

- Rtbet Login 430 3

- Rtbet Login 587 3

- Rtbet Login 605 3

- Rtbet Promo Code 158 3

- Rtbet Promo Code 350 3

- Rtbet Promo Code 881 3

- Rtbet Recensioni 441 3

- Rtbet Recensioni 521 3

- Rtbet Recensioni 534 2

- Rtbet Recensioni 609 3

- rubds54.ru 4-8 1

- sansalvatrail.ch 1

- Satbet Apk 583 3

- Satbet App Download Latest Version 760 3

- Sg Casino App 298 3

- Sg Casino Erfahrungen 157 3

- Sg Casino Login 192 3

- Sg Casino Online 503 3

- Sgcasino 155 2

- Site Apostas 619 1

- Site De Apostas Futebol 632 3

- Sky Crown App 716 3

- Sky Crown Casino 424 3

- Sky Crown Online 808 3

- Sky247 App Download 107 3

- Sky247 Cricket 367 3

- Sky247 Live 69 3

- Sky247 Live Login 221 3

- Skycity Online Casino 82 1

- Skycity Online Casino No Deposit Bonus 152 3

- Slot 8k8 16 3

- Slot 8k8 368 2

- Slot 8k8 457 1

- Slot Jackpot Monitor Jili 286 1

- Slot Jackpot Monitor Jili 396 3

- Slot Jackpot Monitor Jili 596 1

- Slot Jackpot Monitor Jili 752 3

- Slot Jackpot Monitor Jili 758 2

- Slot Jackpot Monitor Jili 77 3

- Slot Jackpot Monitor Jili 872 2